FROM COINS TO CAPITAL

The place to get advice, invest in diversified portfolios and manage all your cryptos seamlessly.

Upwealth is registered Digital Asset Service Provider (DASP)

The place to get advice, invest in diversified portfolios and manage all your cryptos seamlessly.

by crypto experts

yourself with the right tools

all your assets in one place

Our crypto investment team are committed to market analysis, crafting portfolios that align with your specific needs, risk tolerance, and financial goals. They dedicate countless hours to research and apply strategies on your behalf, so you don't have to worry about timing the market perfectly.

Learn moreCustomize your crypto investments with over 350 coins and tokens. Build and manage your own portfolio using our portfolio builder and specialized tools designed for cryptocurrency investing. Tailor your crypto strategy to your preferences.

Learn more

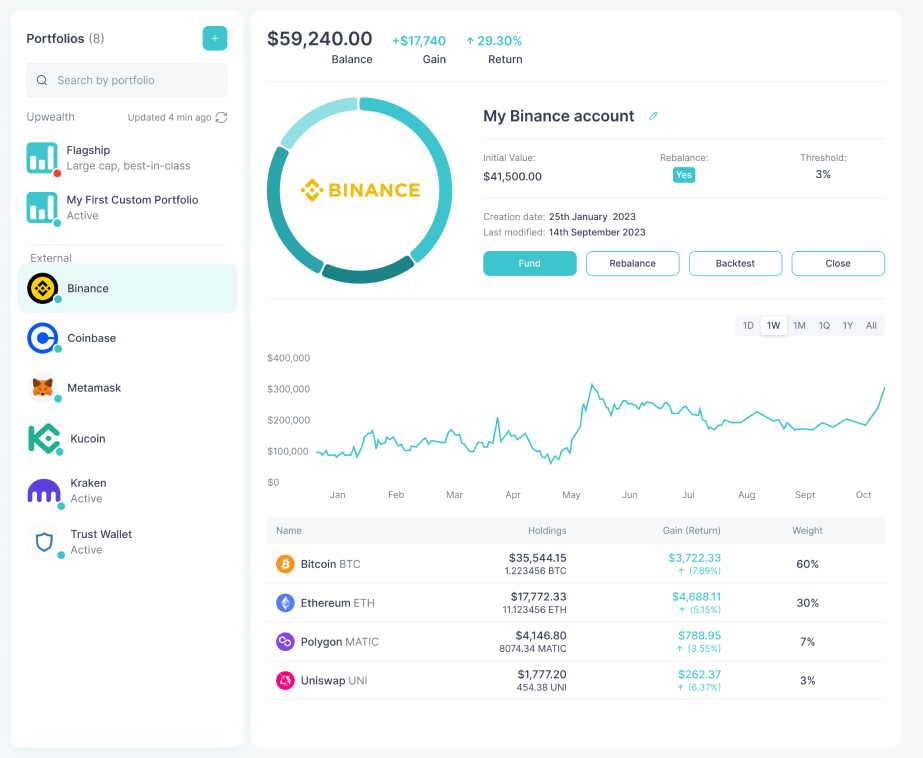

Synchronize all your accounts in one place to see your portfolios and balances in real time. Visualize your P&L, asset allocations and portfolio valuation to make informed decisions. Fine-tune your strategy and keep on track with your financial goals.

Learn moreConnect & Manage over 350+ protocols, wallets, exchange accounts and more…

We are here to guide you, but at the end, your the one to decide.

Answer a few questions and get the portfolio that meet your risk tolerance and investment goals.

Get a free account

Disclaimer: The information provided here is for informational and educational purposes only. It is not intended as investment advice and should not be considered as such. You should conduct your own research and carefully consider your financial situation before making any investment decisions.

Registered as a DASP² with the AMF in France and updating its RIA³ registration with the SEC in the USA.

Third-party specie insurance underwritten through our qualified custodian & liquidity providers.

We uses secure gateway to institutional-grade hot and cold storage with innovative custody & liquidity solutions.